Simply put, in the real estate industry, a 1031 real estate exchange is a switch of one real estate asset for another investment property that is not personal (such as a primary residence).

If you have a profit on an investment property that you are relinquishing, you will most likely be subject to capital gains tax. Depending on what state you live in, this tax can be north of 30%. Under current policy there is no limit to the amount of 1031 exchanges you can facilitate. In other words, “Swap till you Drop”.

Fortitude Investment Group believes this is one of the greatest estate planning tools afforded to real estate investors due to the stepped-up cost basis on inherited assets.

1. Timing Rules Associated with 1031 Real Estate Exchanges

Sellers can never take constructive receipt of funds on a relinquished property as this will automatically trigger a capital gains issue. Rather, funds at closing must be placed with a Qualified Intermediary. In our opinion, it is extremely important to work with a national 1031 Qualified Intermediary firm that is bonded and insured. Please feel free to reach out to Fortitude Investment Group for references on reputable national firms throughout the country.

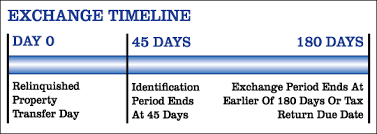

1a. After closing, a seller’s 45-day replacement identification period begins. This means that you only have 45 calendar days to identify a replacement property. After that you have an additional 135 calendar days to close on those properties that you have identified in the first 45 days. If you do not close on any of the properties you have identified, taxes will be due on any equity remaining with your Qualified Intermediary. If you diversified out of a single property into multiple properties and one or more of the multiple properties fall through after the 45 day ID window, you will be responsible for taxes owed on that amount—referred to as “BOOT”.

2. "BOOT”

Simply put, Boot is the cash that is left over that the Qualified Intermediary pays back to you after the 180 days. It is cash that has not been used in the 1031 exchange and is typically taxed as capital gains.

3. 1031 Real Estate Exchanges “Like-Kind” Is Broad

In other words, you can exchange out of a multifamily dwelling for triple net retail, student housing, or diversified multifamily properties, etc.

4. Mortgage Debt Must Be Replaced at Equal or Greater Levels on the Replacement Properties

This debt can be replaced by cash, but all net equity must be reinvested in the new property. Any equity retained after 180 days will be fully taxed.

5. Get Educated on 1031 Real Estate Exchanges Utilizing the Delaware Statutory Trust (DST) if You’re an Accredited Investor

1031 real estate exchanges utilizing the DST may be a viable alternative for many accredited investors looking for passive solutions on their replacement properties.

For as little as $100,000, you can relinquish your investment properties and diversify into institutional quality securitized real estate bought through Delaware Statutory Trust’s for a deeded beneficial interest in the entire DST. This can give you, as an accredited investor, the ability to diversify into multiple DSTs in various sectors such as multifamily, net lease, healthcare, student housing, etc. These alternative property investments are 100% passive investments to you and you hand over all control to the sponsor managing the DST.

Typically, the lifespan of a DST program is 7 to 10 years. They are illiquid investments and are meant to be held for the lifespan of the program. Once the sponsor sells the property you are free to exchange your own property, continue investing into DSTs, or pay the taxes due from their original cost basis of the original property sold.

There are unique features associated with DSTs as they come in all shapes and sizes. Some are single dwellings and others are multiple buildings in multiple states. Some are all cash offerings and some come with as much at 83% loan to value (Debt). Typically, we encounter offerings that are in the 50% LTV range.

If you need to replace debt on an exchange, the debt is held at the sponsor level. This means you do not have to be underwritten nor does the assumed debt show up on your credit. You receive all the potential benefits of the debt on the property while the debt remains non-recourse to you, the accredited investor. All cash investors can easily level up on DST investments as well.

DSTs may also be great backups if you are an exchanger in your 45-day window in case one of your identified properties falls through. They may work great for boot issues on your exchange as well. In addition, as soon as your money hits your Qualified Intermediaries account you can typically can close in a week's time and your income begins immediately.

As with all investments there are pros and cons, as well as risks to any investment and you should consult with your Real Estate attorney, CPA and Registered Representative to see if a 1031 exchange using a DST is the proper avenue to explore.

The acquisition or sale of a Delaware Statutory Trust (DST) for the purpose of a tax-deferred 1031 exchange qualifies for treatment under section 1031 of the Internal Revenue Code ("1031 Exchange"). Investors will be able to sell the existing investment property or beneficial interest in a DST and complete a 1031 exchange into another "like-kind" investment property or beneficial interest in a new DST.

There are risks associated with investing in a Delaware Statutory Trust (DST) and real estate investment properties including, but not limited to, the loss of the entire principal, declining market value, tenant vacancies and illiquidity. DST 1031 properties are only available to accredited investors (generally described as having a net worth of over $1 million dollars exclusive of primary residence or $200,000 income individually/$300,000 jointly of the last three years) and accredited entities only.

The information herein has been prepared for educational purposes only, does not constitute an offer to purchase or sell securitized real estate investments, and is not meant to be interpreted as tax or legal advice. Because investors situations and objectives vary this information is not intended to indicate suitability for any particular investor. Please speak with your legal and tax advisors for guidance regarding your particular situation. Diversification is not a guarantee of future results.Securities offered through Concorde Investment Services, LLC (CIS), member FINRA/SIPC. Advisory services offered through Concorde Asset Management, LLC, an SEC registered investment adviser. Insurance offered through Concorde Insurance Agency, Inc. Fortitude Investment Group is independent of CIS, CAM and CIA.

Let Us Know What You Thought about this Post.

Put your Comment Below.